This guide covers how to set up and configure holidays in paiyroll®.

Overview #

The principle is that pay received by a worker while they are on holiday should reflect what they would have earned if they had been working

Different working patterns are supported as shown below:

| Work pattern | Fixed | No |

|---|---|---|

| Description | Fixed hours and pay including part-time | No fixed hours e.g. casual work, zero-hours contract, irregular |

| Reset date (Year starting) | Date in the scheme rolled forward each year | Worker’s start date rolled forward each year |

| Entitlement (set on employee Pay Item input) | Annual entitlement | Entitlement earned – calculated and updated after payrun approval |

| Holiday balance after import | Zero | Zero |

| Entering entitlement after import | Enter the remaining balance at date of import as the annual entitlement. e.g. full entitlement is 28 days and 5 days taken prior to import, enter 23. Just after the next reset date, enter the full annual entitlement of 28. | Enter full annual entitlement |

| Carried over, Bought and Sold | Displayed if scheme limits are not zero | Displayed if scheme limits are not zero |

| Remaining this year | Annual entitlement + (Carried over + Bought – Sold) – Approved bookings | Entitlement earned + (Carried over + Bought – Sold) – Approved bookings |

| Entitlement year to date | Displayed after payrun approval for information | – |

| Pay out on leaving | Automatically | No |

| Pay out on holiday anniversary date | Automatically | No |

Display and reports #

All days, dates and durations listed above are displayed when the holiday request is first created on the mobile view. The same information is then available when a request is approved by a manager or administrator.

The Pre-approval summary2 report Holiday entitlements tab includes the full holiday report.

Step-by-step set up #

Here are the steps to set up holiday:

First, you will need to determine which Pay Definitions contribute to holiday pay. To do this you will need to categorise every Pay Definition and whether it forms part of holiday pay. You will have 2 lists, those included in Holiday pay and those excluded:

Included

Excluded

Salary based items are always included.

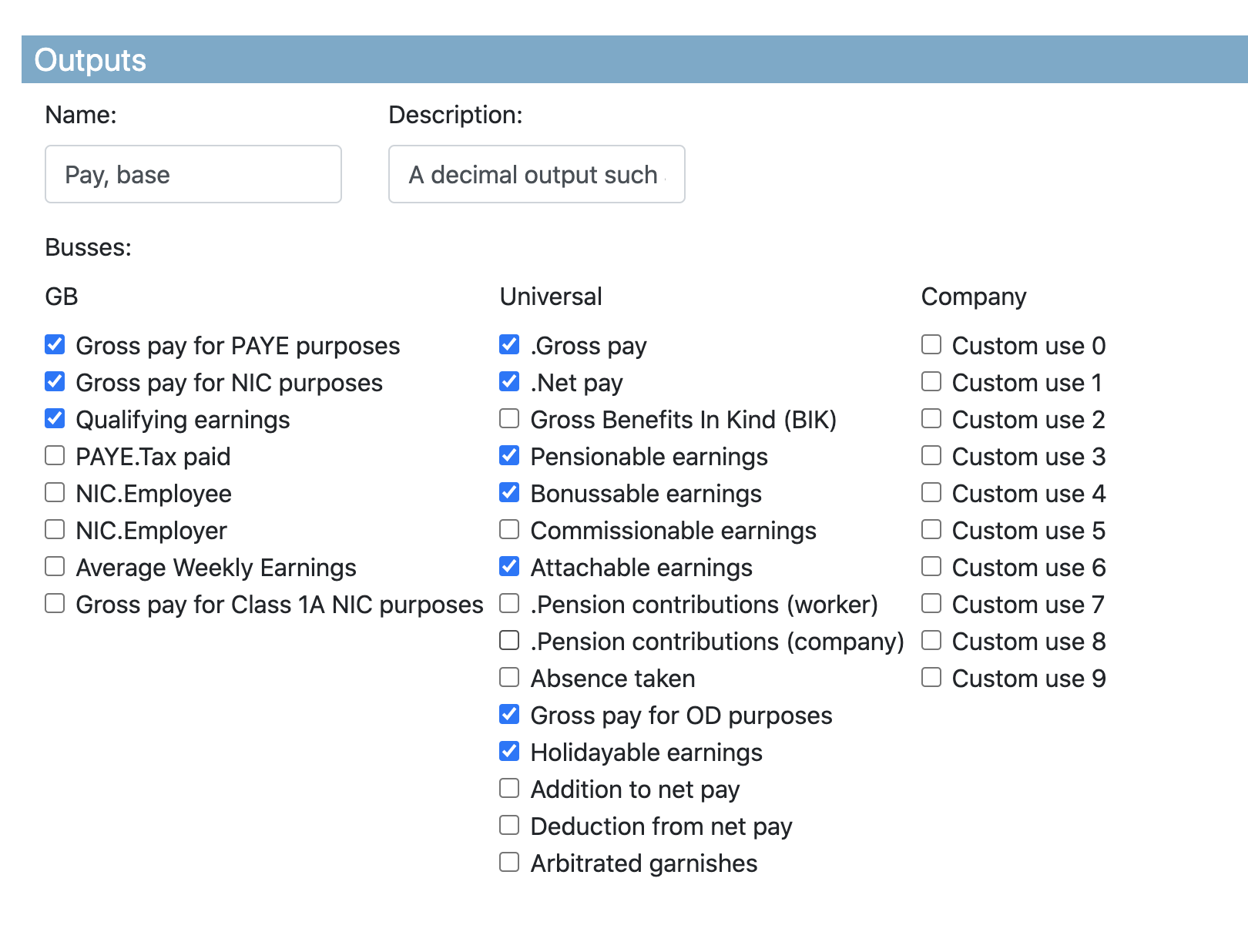

By default payment Pay Definitions are set to contribute to holidayable earnings and are by default included. That means the Output on the Pay Definition is checked (a tick mark) for the Holidayable earnings Buss.

Remove Pay definition outputs from the Holidayable earnings buss for any category of Pay Definitions that should be excluded from holiday pay. This is done by editing each Pay Definition and un-ticking (clearing the checkmark) for the output which connects to the Holidayable earnings. Once complete, the system will automatically maintain the history of all included values on the holidayable earnings buss.

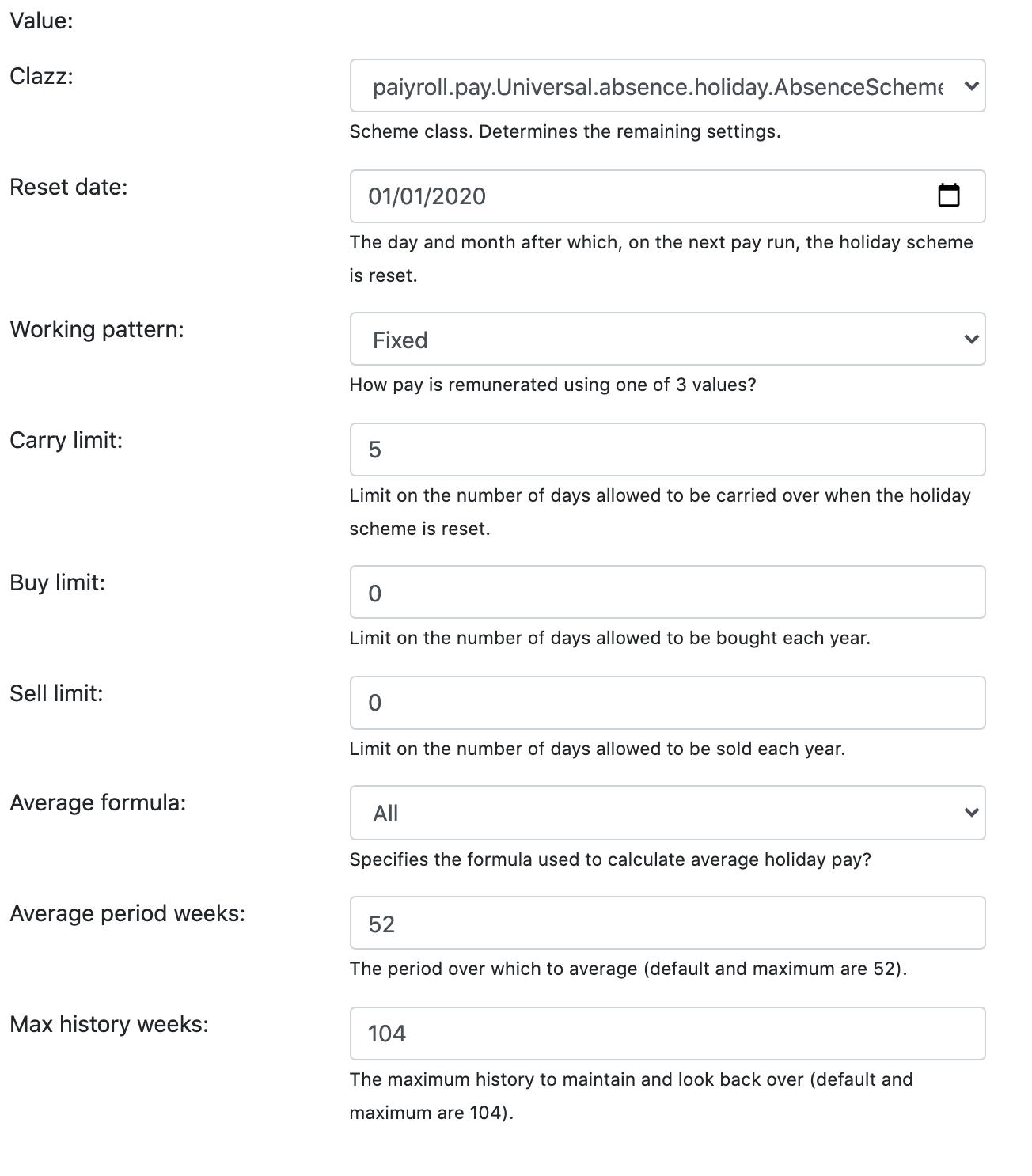

The next step is to add a Holiday Pay Definition scheme. Add a Pay Definition using the Holiday scheme Pay Template. Set the Inputs according to your scheme:

Reset date is the holiday anniversary date. This is used for Fixed work pattern but not for No work pattern.

Working pattern should be set to Fixed for salary-based employees and No for zero-hour contract workers

Carry limit can be used to limit how many unused days can be carried over

If you operate a holiday buy/sell arrangement, then Buy limit and Sell limit can be used to limit the number of days bought or sold in a holiday year. Simply set to zero if not used

Average formula is normally set to All for fixed employees and Only paid w1 (only paid weekly) for workers with no fixed pattern

Average period weeks defined how many weeks should be used for averaging weekly pay. 52 weeks is the default

Max history weeks is normally set to 104 weeks to comply with the new holiday pay law.

Note

If you have different types of workers, then you can set up as many schemes as required.

Attach a Holiday Pay Item to each worker using the

Pay Item editor:

Select the holiday Pay Definition created above for the frequency required (e.g. m1 or w1) and click Create to add a Pay Item to each worker

Click Update to confirm the change

In the row for the newly added Pay Item, set the Annual entitlement to the number of holiday days e.g. 28

Set the Scheme to the scheme defined earlier

Click Update to save these changes

Operation #

Holiday operates as follows:

- Holidays are booked and approved using a holiday workflow thereby recording the start, end and holiday duration.

- All repeating Pay Items (based on Salary Pay Template) continue to output ‘pay’ during any holiday.

- Non-repeating Pay Items that are likely to decrease, will be compensated by holiday pay. This is automatically calculated and provided by the Holiday Pay Item.

- Excluded Pay Items are by definition excluded.

- Unused holiday pay is paid out on leaving or at holiday anniversary for employees on a Fixed working pattern.