When a worker’s payslip appears to show an incorrect payment or deduction, paiyroll® has unique features to help work out what the problem might be using the Analyse tab.

Display the Pay Diagram #

Let’s say that worker Sherlock Holmes has queried their NIC deductions for the pay run on 2019-07-28. The first thing to do is to go to Pay runs and then View:

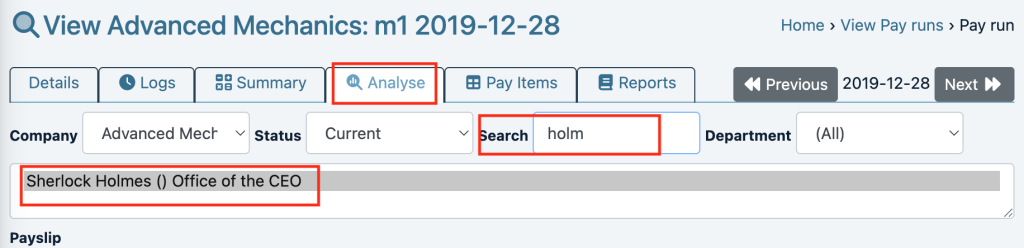

Next, click the Analyse tab, and search or select Sherlock Holmes from the drop-down:

The payslip will be displayed at the top. Below the payslip is a Pay Diagram, comprising displayed text fields followed by a block diagram.

View the Deduction of concern #

For example, to check the NIC:

- Select NIC – National Insurance (NI) in Details

- Click on the NIC square box in the diagram to bring up all the data for NIC:

Four panels of data are shown:

Item: is the name of the Pay Item

Inputs: You will see the “Inputs” to NIC came from a Buss called “Gross pay for NIC purposes” and totalled £2000.00. Also displayed is a diagram showing:

- The blocks which provided the inputs to the NIC.

- The NIC block.

- The blocks where the outputs from the NIC went.

In this case, the NIC is driven by AE, Salary, Book holiday and so on. Similarly, NIC itself drove GB Liability. By clicking on these blocks, you can quickly see how values moved through the system from left to right. This will help you identify any unexpected values.

Outputs were £153.72 for Employee NIC and 176.78 for Employer NIC.

State: shows all the year-to-date values stored after the pay run

Hint: If you find that a block which was expected to drive NIC is not shown, check the Pay Definition for that block and review the Busses configured on its outputs.

Banded deductions #

Many deductions are “banded”, that is to say that the percentage or amount of the deduction will be constant even if the relevant earnings vary within certain upper and lower limits. Examples where the percentage is banded include:

- GB PAYE

- GB NIC

Examples where the amount is banded include:

- GB Pensions which have been configured as banded.

Notice that in these cases, people earning different amounts in different pay periods, or different people earning different amounts with the same contribution percentage, may have the same deduction!